Impending Doom

The econo-blog-o-sphere is quite certain that we aren't in for a soft landing when it comes to the current housing price bubble. The fine folks over at Autodogmatic put not too fine a point with:

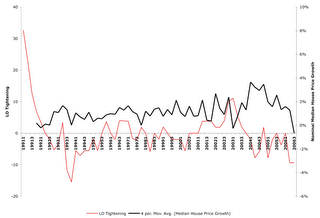

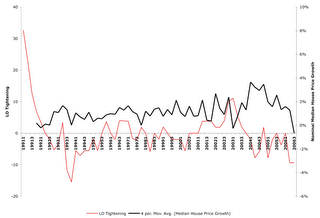

I thought I'd ask the loan officers what they think. Well, I didn't do this, but the fed was clearly able to get a coherent sentence or two from the fine men and women at the front lines of our credit crisis. So, I thought I'd put together a little chart to highlight one small point, namely that loan officers want to relax credit standards when housing prices drop. Now if we are to believe that housing prices are falling due to A & B above, then I don't quite see how that environment is conducive to relaxed lending standards.

If you don't agree with me, try this little quiz: (1) Do you believe the mortgage interest rate risk in the next few years is to the (A) upside or (B) downside? (2) Do you believe median incomes are trending, in real terms, (A) up, or (B) down.

If you answered "A, B", you can give yourself a pat on the back for honesty. But you've also just implied that the housing bubble ain't comin' back any time soon.

If you answered anything else, your views are either incoherent or totally disconnected from reality.

I thought I'd ask the loan officers what they think. Well, I didn't do this, but the fed was clearly able to get a coherent sentence or two from the fine men and women at the front lines of our credit crisis. So, I thought I'd put together a little chart to highlight one small point, namely that loan officers want to relax credit standards when housing prices drop. Now if we are to believe that housing prices are falling due to A & B above, then I don't quite see how that environment is conducive to relaxed lending standards.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home